Remora Markets, Flash Trade Elevate Solana RWA-Fi with NASDAQ Swap Pool

Permissionless arbitrage means anyone can be a TradFi market maker on Solana

- Published:

- Edited:

Solana DeFi has taken a critical step towards RWA composability. In collaboration with Remora Markets, Flash Trade has launched Solana’s first oracle-based, permissionless swap pool for tokenized stocks, enabling traders to trade rStocks at NASDAQ prices.

The launch unlocks a wealth of new arbitrage opportunities for Solana DeFi users, who previously relied on tokenized stock issuers to manually ensure prices were consistent with TradFi markets.

Permissionless arbitrage has been one of the key missing pieces of Solana RWA-Fi, which has been one of the network’s biggest growth sectors in 2025.

Flash Trade Launches Permissionless rStock Swap Pool

Flash Trade, a Solana perps DEX, has launched a first-of-its-kind DeFi RWA product, enabling users to trade Remora Market’s rStocks at their NASDAQ-listed pricing regardless of onchain values.

This tool effectively brings permissionless arbitrage opportunities to the average Solana DeFi participant. Powered by Pyth pricing oracles, traders can profit from discrepancies between onchain rStock prices and their NASDAQ values.

Beyond swapping tokens directly at TradFi prices, Solana DeFi users can also provide liquidity to the Flash Trade liquidity pool, earning fees from arbitrageurs’ trades.

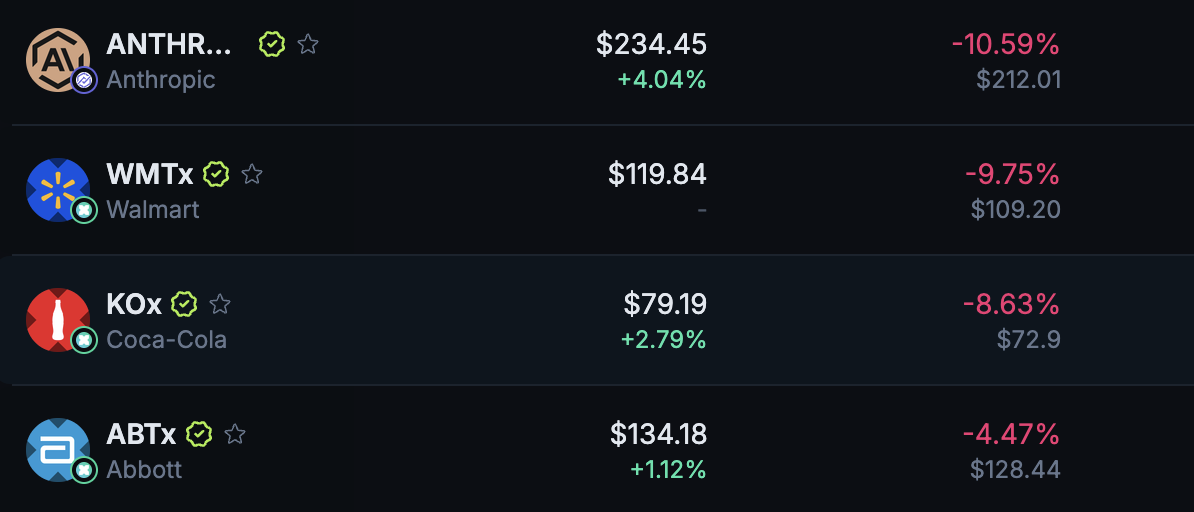

At the launch, the pool will support all 5 Remora assets: $TSLAr, $SPYr, $NVDAr, $CRCLr, and $MSTRr. Pyth pricing feeds will operate on a 24/5 market cycle, meaning the redemption pool will be closed on weekends and U.S. bank holidays.

NASDAQ Arbitrage: A Critical Inflection Point for RWAs

Flash Trade’s swap pool solves one of the biggest pain points in Solana DeFi’s RWA scene. Despite the promise of tokenized stocks mirroring their TradFi counterpart, onchain assets often trade at a large discrepancy to their ‘real-world’ value.

In the days before Flash Trade’s oracle-based swap pool, traders seeking to profit from these variations in pricing had no option but to wait for the token issuer to rebalance prices manually. The average DeFi user had no tool through which they could take matters into their own hands and play the role of the market maker.

By providing a permissionless pool, Remora Markets and Flash Trade are bringing more efficient RWA markets to Solana DeFi. Holders of rStocks get more accurately priced assets, while arbitrageurs gain an easy and accessible new tool to generate profit while bridging the gap between onchain and offchain markets.

RWAs Enjoy Rapid Growth on Solana

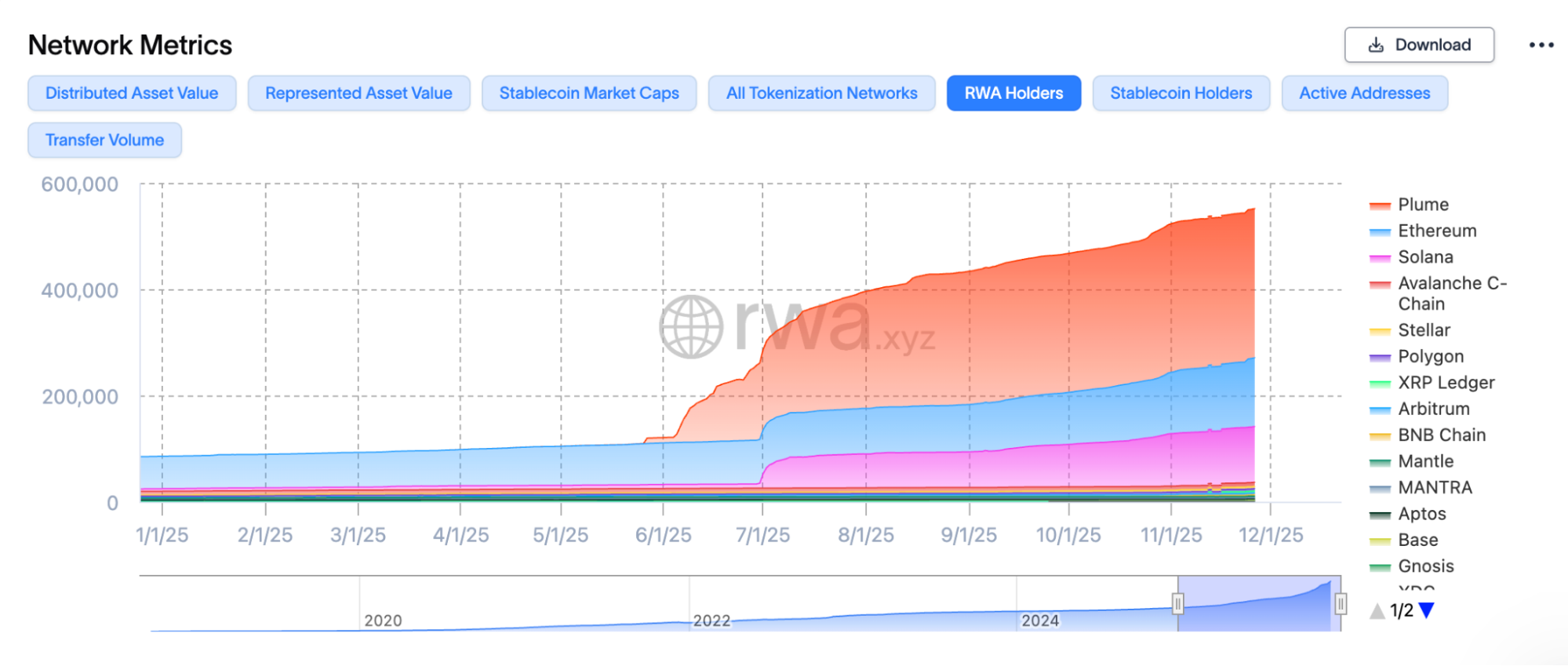

Despite a slow start to the tokenization race, Solana has been making up for lost time in recent months. While Ethereum is undoubtedly the greatest source of RWA TVL across the crypto industry, Solana’s RWA scene is arguably far more accessible among the retail crowd.

According to RWA.xyz data, Ethereum commands 63.91% of RWA market share across all sectors. However, despite Ethereum’s dominance of RWA TVL, the number of wallets holding RWAs on Ethereum is only 23% higher than on Solana.

Although easily gamable, this metric could suggest that RWA adoption may be higher among network participants with smaller portfolios, namely retail users. This is further supported by Solana’s dominance of the tokenized stock sector, with the network processing 95% of all onchain stock trading volume.

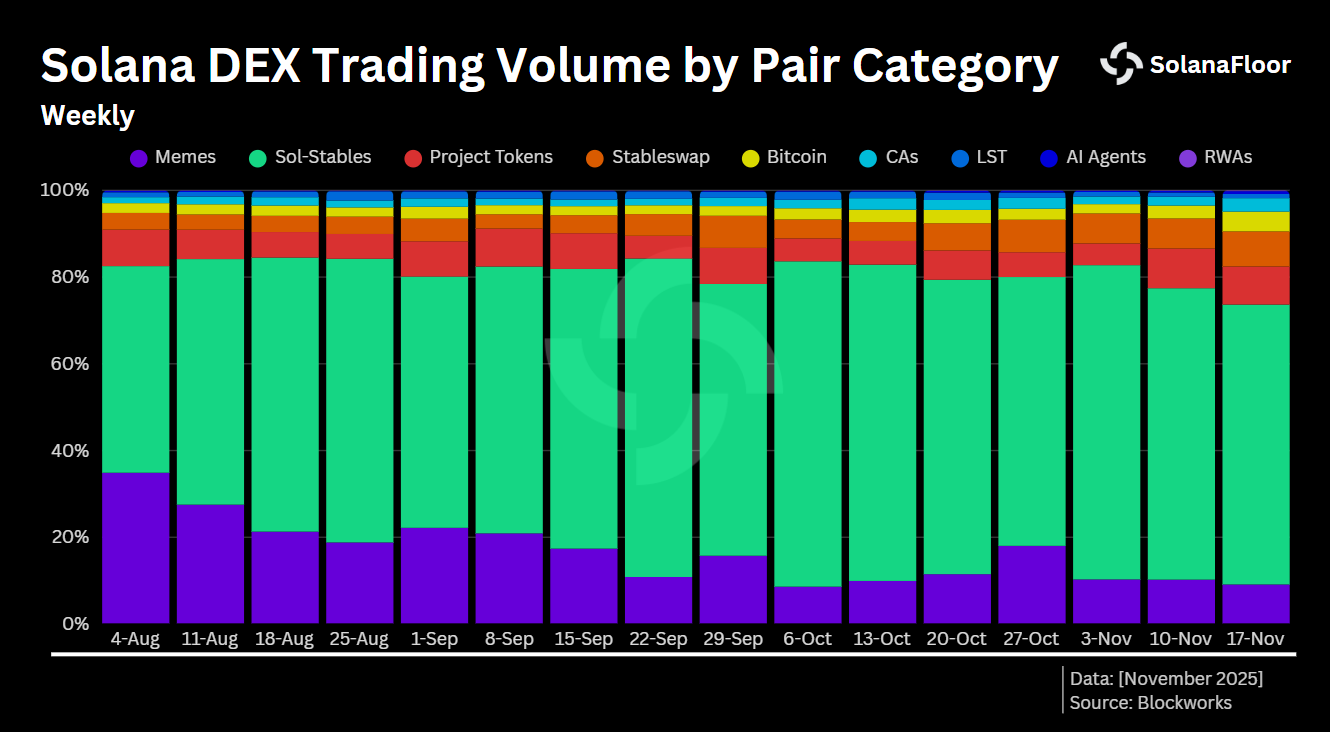

Onchain data of trader behaviour lends further credibility to this thesis. A recent SolanaFloor Data Insights report found that Solana’s memecoin trading volume could be shifting to more mature asset classes, like RWAs.

Read More on SolanaFloor

Solana Leads Race to House All Onchain Finance

Solana Asserts Position as the “Everything Exchange” - Outpacing Hyperliquid in $MON Trading Volume

Solana ETFs Are Changing Everything